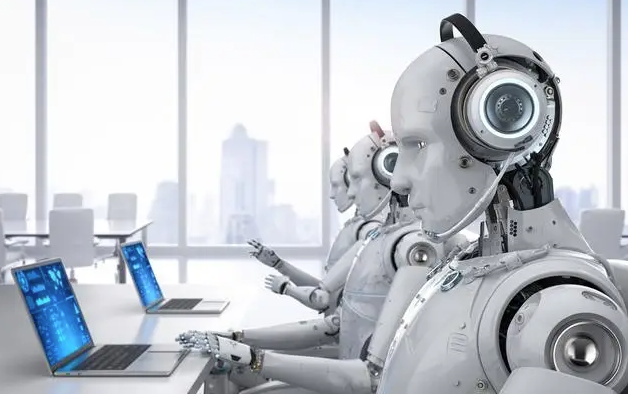

AI Digital Human Services

AI Digital Human Intelligent Customer Service

1. Core Technology Architecture

-

Multimodal Interaction System

Integrates voice recognition, visual perception, natural language processing and other technologies to achieve "seeing, hearing, speaking, touching" full-dimensional interaction. For example, in banking scenarios, digital customer service can analyze customer micro-expressions, dynamically adjust communication strategies, and improve response speed by 40%.

-

Intelligent Decision Engine

Uses reinforcement learning framework to optimize dynamic strategies, supports enterprise customization of large model output content, and improves service granularity through continuous learning mechanisms.

-

Emotion Computing Module

Captures user tone, micro-expressions and other non-verbal signals, combined with semantic understanding to achieve human-like communication, with customer satisfaction indicators increasing by an average of 42%.

2. Core Service Advantages

-

Efficiency Breakthrough

Daily processing volume reaches 12 times that of traditional manual teams, complex business processing accuracy exceeds 92%, and single response time is compressed to within 0.8 seconds.

-

Cost Optimization

Standardized problem processing reduces manual input by 70%, 7×24 hour service reduces operating costs by 30%, especially suitable for high-frequency scenarios such as finance and retail.

-

Experience Upgrade

Provides personalized services based on historical data, such as automatically identifying customer identity and recommending products, extending customer stay time by 2.1 times, and increasing conversion rate by 28%.

3. Typical Application Scenarios

-

Financial Sector

Virtual customer managers handle 5000+ consultations daily, reducing business processing time by 40%. Insurance claims verification builds closed-loop service chains through multimodal technology.

-

Education and Healthcare

Virtual teachers adjust teaching rhythm based on student pupil changes. Chronic disease management scenarios achieve remote consultation assistance.

-

Retail Services

Digital shopping guide system automatically identifies clothing style preferences and synchronizes inventory information. Customer consultation conversion rate increases by 28%.

AI Vehicle Insurance Intelligent Damage Assessment Service

1. Core Technology Architecture

-

Image Recognition and Damage Classification

Based on deep learning technology, achieves precise recognition of vehicle exterior components (such as bumpers, doors, headlights, etc.), and supports intelligent judgment of five types of damage including scratches, dents, and punctures, outputting numerical results of damage area and location.

-

Full Process Automation

From customer self-upload of accident pictures, AI damage assessment model analysis, to automatic generation of claims solutions and case closure, the entire process requires no manual intervention. For example, Taikang Online's "Tai Yi Pei" system can complete agreement signing within 1 minute, improving efficiency by over 90% compared to traditional processes.

-

Augmented Reality (AR) Dynamic Scanning

Through AI voice guidance, customers can scan vehicle damage parts in real-time, with algorithms automatically controlling shooting parameters (such as focal length, angle), dynamically generating 3D damage models, significantly reducing user operation threshold and improving data accuracy.

2. Service Advantages and Results

-

Efficiency Breakthrough

Daily processing volume reaches 15 times that of traditional manual damage assessment, single case processing time compressed to seconds. For example, China Pacific Insurance's "Tai·AI" can directly generate damage assessment solutions and complete payment through video or pictures.

-

Cost Optimization

Standardized case processing costs reduced by 70%, manual verification workload reduced by 80%. Ping An Insurance's AI damage assessment patent shortened claims cycle from days to hours, significantly reducing operating expenses.

-

Experience Upgrade

Customers can view claims progress in real-time through mini-programs and receive risk avoidance suggestions (such as driving safety tips). Taikang Online's "Agreement Palm Sign" function improved signing efficiency by 120 times compared to traditional face-to-face signing.

3. Typical Application Scenarios

-

Small Claims Quick Assessment

Vehicle owners independently take and upload damage pictures, AI automatically identifies components and damage types. For example, Ping An Insurance's intelligent damage assessment system supports "zero-contact" claims for customers with good credit.

-

Complex Damage Precise Judgment

For multi-component damage or hidden damage (such as A-pillar folds), AI combines historical data with repair logic to output damage assessment solutions, with accuracy exceeding 95%.

-

Remote Claims and Risk Management

In scenarios such as heavy rain and hail, customers can remotely submit vehicle damage information, while the system synchronously pushes surrounding repair resources and estimates repair costs, reducing secondary damage risk.

Need Customized Services?

We can provide tailored AI digital human service solutions based on your specific needs

Contact Us